How the 2024 Presidential Election Could Impact Mortgage Rates and Market Volatility

As the 2024 presidential election approaches, uncertainty in financial markets grows, impacting everything from stock performance to mortgage rates. While elections alone do not dictate mortgage rates, they contribute to an environment where economic conditions shift, influencing housing and interest rates. Here, we’ll explore how past elections have affected mortgage rates and what homebuyers and homeowners should consider as they navigate the current landscape.

Election-Related Market Volatility and Mortgage Rates

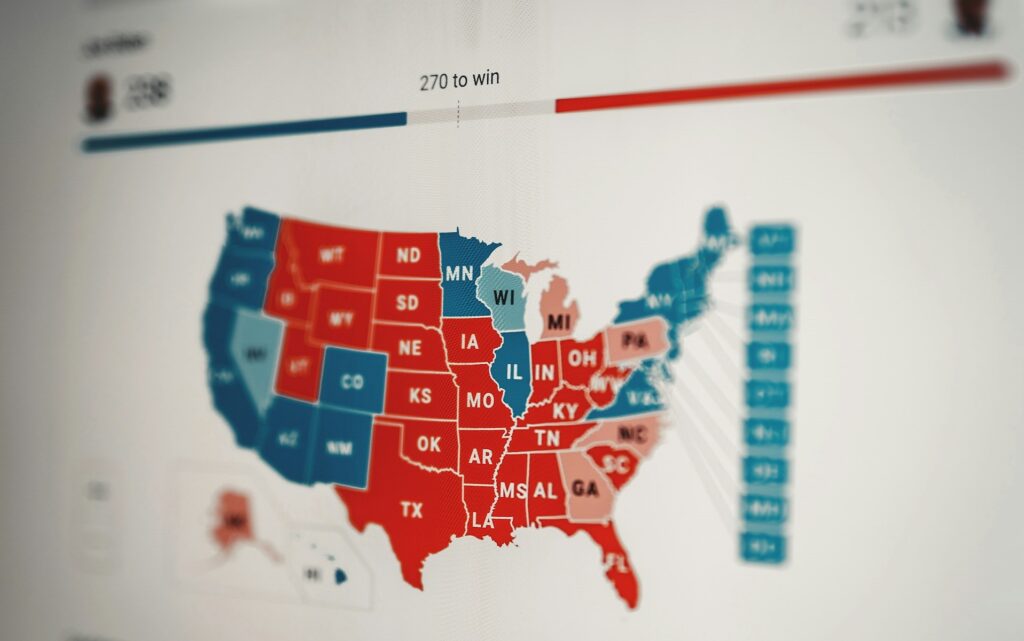

Election years often add a layer of complexity to financial markets. Historically, when political outcomes are uncertain, market volatility increases. This year, betting markets and polling data have fluctuated, causing ripple effects on bond yields and mortgage rates. Recent trends indicate that, should former President Trump win, mortgage rates may edge higher due to market expectations of policies favoring growth and inflation. Conversely, a victory for Harris might lead to a “friendly correction,” reducing rates as markets anticipate a steadier economic approach.

For now, average mortgage rates for a top-tier, 30-year fixed loan hover around 7%. While this figure is down from last week’s highs, analysts agree that the uncertainty will persist until election results are finalized.

The Role of the Federal Reserve

A key player in managing economic stability during election cycles, the Federal Reserve indirectly influences mortgage rates through adjustments to the federal funds rate. Although the Fed does not set mortgage rates directly, its monetary policy decisions, especially around inflation control, guide the cost of borrowing. In 2020, for instance, the Fed’s near-zero rates helped push mortgage rates to record lows as it sought to stabilize the economy during the COVID-19 pandemic.

In 2024, the Fed is again balancing inflation concerns with economic growth, which means any shift in the presidency could also influence future policy decisions by the Fed, potentially affecting mortgage rates indirectly.

Historical Trends in Election Years

Historical data shows mixed impacts of elections on mortgage rates. In the 1980 election, inflation was high, and mortgage rates peaked at 16%, primarily due to the Fed’s aggressive inflation-fighting measures rather than the election alone. In 2008, amid the Great Recession, the Fed’s rate cuts kept mortgage rates low to support economic recovery. More recently, in 2016, rates rose following Trump’s win, reflecting market optimism for pro-growth policies.

Such trends reveal that while elections contribute to market movement, they typically amplify existing economic conditions rather than initiate change. In uncertain times, investors and buyers may take a “wait-and-see” approach, which could lead to temporary dips in home sales and refinancing activity.

Inflation Expectations and Economic Growth

A candidate’s policies can shape inflation expectations, which in turn affect mortgage rates. Growth-focused policies could increase inflation, leading to higher mortgage rates. Alternatively, a conservative fiscal approach may signal stability and potentially lower rates. This dynamic was visible in previous elections, where mortgage rates adjusted to align with expected inflation based on the winning party’s economic stance.

Should Homebuyers Lock in Rates?

Given the unpredictability of election outcomes, homebuyers and homeowners should consider locking in their mortgage rates if they are concerned about potential rate increases. A rate lock secures a specific rate, protecting borrowers from unexpected market shifts. As market volatility often spikes around elections, locking in a rate provides peace of mind amid uncertainty.

For those considering a home purchase or refinance, now may be a strategic time to act. While post-election adjustments are possible, today’s rates reflect current economic conditions, and a future rate cut could present opportunities to refinance.

Final Thoughts

Election years bring both opportunity and uncertainty. While Independent Home Finance Inc. cannot predict the exact impact of the upcoming election on mortgage rates, we can help clients navigate market shifts with expertise. As always, working with an experienced mortgage professional ensures that you stay informed about market trends and have the right strategy in place, regardless of political changes.